Euler Financial Loses Nearly $177 Million in Hack

Decentralized finance (DeFi) has been making headlines in recent years, as a new and exciting way to conduct financial transactions without the need for intermediaries. However, with any emerging technology comes risks, and DeFi is no exception. DeFi is no different from other newly developed technologies in that it has some hazards. The DeFi group saw its biggest cyberscam to date in 2023, when a cyberattack cost Euler Financial around $177 million. This incident was a major wake-up call for the industry, highlighting the need for improved security measures and protocols.

What’s happening

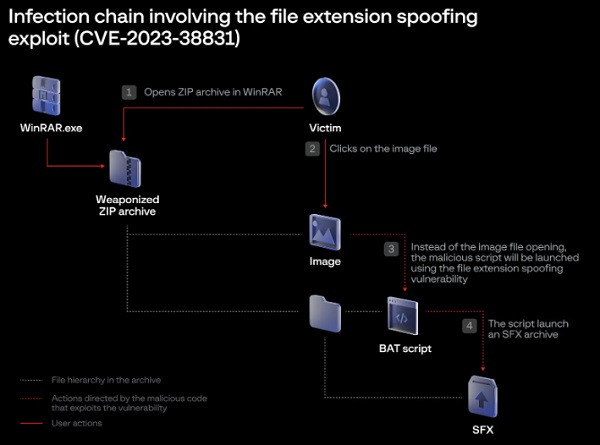

• A brand-new attack known as a “Protocol DeFi Marking” attack are built on blockchain networks and are not governed by any banks, brokers, or middlemen.

• They provide users with anonymity and authority over how they manage their cash. Instead of targeting specific users or exchanges, this kind of attack seeks to exploit flaws in the DeFi protocols itself.

• In this case, the hackers were able to exploit a vulnerability in Euler Financial’s protocol, allowing them to steal a large amount of funds.

See more: Hackers exploit a 3-Year-Old Flaw to Breach a U.S. Federal Agency

When Euler Financial’s security team detected an unusual level of activity on the platform, they realised that an attack had taken place. Investigation led them to the conclusion that the platform’s smart contract had been breached, and the money had been transferred to an unidentified location. The team acted right away to stop all platform transactions and inform users of the issue.

The hack had significant repercussions for both Euler Financial and the DeFi sector as a whole. DeFi protocols depend on openness and trust, and this occurrence damaged those qualities. It also emphasised the requirement for enhanced security protocols and methods to defend against such assaults.

An attack on the Euler protocol resulted in the theft of nearly $200M worth of crypto assets. Despite multiple code audits, vulnerabilities can still be found. Check out this article to see how the attack was executed. https://t.co/s94KZt3Bw7 #EulerProtocol #DeFi #cryptosecurity

— IntoTheBlock (@intotheblock) March 14, 2023

New security procedures and protocols have been put in place on Euler Financial and other DeFi platforms as a result of the hack to stop this from happening again. These actions consist of improved audits, more openness, and the use of multi-signature wallets.

See more: New Cryptojacking Targeting Kubernetes Clusters for Dero Mining

Despite the negative impact of the attack, it also served as a catalyst for the industry to improve and strengthen its security measures. DeFi has the potential to revolutionize the financial industry, but it must first address the security concerns that come with such an innovative technology.

An important wake-up call for the DeFi business was provided by the Protocol DeFi Marking assault on Euler Financial in 2023. While it exposed the flaws in DeFi protocols, it also gave the industry the impetus it needed to strengthen its protocols and security procedures. In order to maintain the trust and confidence of its users, DeFi must emphasise security as it expands and changes.

Author: Yogita Bhoi

We hope you found article interesting. For more exclusive content follow us on Facebook, Twitter and LinkedIn